You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The only problem with this rise in AUD is that (as pointed out in a couple of previous posts) all the riff raff are starting to predict a much higher AUD/USD rate, and those predictions are starting to get media attention.

The contrarian in me doesn't like that at all

System still long, and has been since late December.

KH

The contrarian in me doesn't like that at all

System still long, and has been since late December.

KH

- Joined

- 8 June 2008

- Posts

- 14,706

- Reactions

- 22,348

the contrarian in me does not like it when he sees 5 figures in AUD loss on a week due to currency exposure

Yes, I'm in the same boat as you, but not to the same extent. I'm holding USD and EUR to satisfy MTM requirements, but that's all. Friday and Monday were particularly bad, Tuesday so-so, and I'm not looking forward to seeing currency losses when Wednesday's statement is released in a few hours time.the contrarian in me does not like it when he sees 5 figures in AUD loss on a week due to currency exposure

KH

- Joined

- 28 May 2020

- Posts

- 7,417

- Reactions

- 14,512

If any of you are in agreement that the US is heading for a recession (I am leaning towards it at the moment, but only just), then a look at the historical movements of the AUD/USD pair in past recessions will show that the AUD gets hammered with the strange "flight o quality" meme that permeates US markets.

Hope any recession is still a bit further away, as I want to buy USD on the way up

Mick

Hope any recession is still a bit further away, as I want to buy USD on the way up

Mick

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,972

- Reactions

- 7,436

Time to buy more US shares.

Aussie dollar a ‘global haven’ as US economy deteriorates

The 15 per cent rise in the Australian dollar in just under four months is not only lowering export revenues and cutting import costs but it is starting to change the behaviour of those Australians insulated from higher interest rates.

This week I met a mortgaged small business person serving affluent clients. The higher mortgage rates are a pain but his clients are accepting much higher prices and suddenly the higher Australian dollar is putting travel to the US on the agenda.

If the currency keeps rising, such overseas travel agendas will become a reality.

Australians need to understand why our local currency has moved from its status of a “battler” to now becoming one of the favourite havens for global currency traders.

In the process it tells us what world currency traders believe is going to happen Down Under. The dollar was languishing around US62c just four months ago and is now hitting the US71c mark. And it shows signs of going higher, perhaps to the US75c cent mark reached last April -that would represent a 20 per cent increase from the October low.

Such sharp rises in our currency are slashing both export revenues and import costs creating traps for exporters and importers.

Those investing overseas unhedged are suffering.

We need to acknowledge that part of the strength of the Australian dollar against the US dollar is a weakness in the American currency.

The US economy is deteriorating and with that deterioration comes lower bond interest rates and an expectation that the US Federal Reserve will lift not interest rates as far as markets had expected.

By contrast, currency traders look at Australia and are delighted to see our annual headline inflation holding at the 7.8 per cent rate while at the same time, unlike the US, many large companies are trading very well.

Some are expecting this strong trading to continue during 2023. To currency traders that means Australian interest rates must keep rising.

In addition, for many traders, the Australian currency is seen as a safe way of betting on China which, having abandoned its harsh Covid restrictions, looks set to have a post-Covid boom. In turn, that will boost Australian exports.

It is also likely that the Chinese will release a large number of the trade embargoes it placed on Australia.

his week moving around a number of enterprises I discovered, surprisingly, that in the building industry demand for basic materials remains very strong and forward orders are high right through until the end of 2023. Government infrastructure helps.

The rate of building cost inflation has slowed considerably and some areas, like steel and timber, there have been price falls. But carbon emission charges on raw materials like steel and cement could change that.

Earlier this week I reported that in the retail sector demand in enterprises dealing with customers outside the depressed mortgage and rent belts, remained strong in January, particularly in Victoria. Climate has impacted NSW and Queensland

And the shortage of labour remains chronic. That means companies have to pay higher salary levels to gain skills and existing staff costs are often boosted by working from home demands.

There is clear risk there be a higher level of wage increases given the 7.8 per cent headline inflation rate.

As the currency traders see it, that means Reserve Bank has no choice but to continue to raise interest rates. But that inflation fighting technique mainly savages just one section of the community - those that borrowed heavily during the property boom on the Reserve Bank-encouraged expectation that interest rates would not rise until 2024.

The pain in that segment of the community will be severe if the Reserve Bank’s official interest rate rises beyond 3.35 per cent as the currency traders are expecting.

Accordingly, to bring down the inflation rate will require torture on this segment of the community that will cause considerable social upheaval and vigorous community demands for big wage rises. And of course that creates a vicious circle. More joy for currency traders bullish on the Australian dollar.

ROBERT GOTTLIEBSEN BUSINESS COLUMNIST

- Joined

- 20 December 2021

- Posts

- 218

- Reactions

- 500

AUD/USD is holding just below 0.6600 after Tuesday's sell-off, and given the divergence in tone between Governor Lowe's recent comments and Fed Chair Powell's testimony, it is interesting to see the lack of follow-through from sellers despite the breakdown.

All trading involves risk, and it may be a signal of possible mean reversion before a more sustained leg lower. It will be worth watching Friday nights NFP as that will likely be the main driver for USD's direction over the coming days.

All trading involves risk, and it may be a signal of possible mean reversion before a more sustained leg lower. It will be worth watching Friday nights NFP as that will likely be the main driver for USD's direction over the coming days.

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

AUD riding highs with the ASX market I would gather, H4 seems contempt to continue the highs into next week, but there's a lot riding on it?

The weaker US dollar has allowed AUD/USD to rise for a seventh day, although a series of upper wicks over the past three days suggests bears are losing steam. A bearish pinbar also formed on Thursday after a false break of the 100 and 200-day EMAs. RSI (2) is overbought, and RSI (15) is around the neutral level of 50 – so if prices turn lower from here, it will revert to bearish mode below 50.

Bears could seek to fade into retracements within Thursday’s range with a stop above its high, or the 38.2% Fibonacci level. 0.6500 make a viable initial target, a break beneath which brings the lows around 0.6450 into focus.

The weaker US dollar has allowed AUD/USD to rise for a seventh day, although a series of upper wicks over the past three days suggests bears are losing steam. A bearish pinbar also formed on Thursday after a false break of the 100 and 200-day EMAs. RSI (2) is overbought, and RSI (15) is around the neutral level of 50 – so if prices turn lower from here, it will revert to bearish mode below 50.

Bears could seek to fade into retracements within Thursday’s range with a stop above its high, or the 38.2% Fibonacci level. 0.6500 make a viable initial target, a break beneath which brings the lows around 0.6450 into focus.

Dona Ferentes

Did the Thessalonians write back?

- Joined

- 11 January 2016

- Posts

- 20,124

- Reactions

- 27,759

looks rather range-bound.

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

Whats the AUD up to....

If we needed a reminder that expectations of Fed policy via bonds and the US dollar remains a key driver for AUD/USD, it is clearly visible on the daily chart. AUD/USD recouped most of Wednesday’s losses as a slew of weaker US economic data drove the US dollar lower, the benefit of AUD/USD.

Friday’s bullish close confirms a 3-bar bullish reversal pattern called a morning star formation. At the beginning of the week, my preferred option is to seek bullish reversal patterns on intraday timeframes if prices retrace within Friday’s range. Yet I do not yet see this as a significant low, and doubt this will rally to 66c. So if this does indeed bounce, I will then be on the lookout evidence of a swing high and for momentum to then turn lower.

If we needed a reminder that expectations of Fed policy via bonds and the US dollar remains a key driver for AUD/USD, it is clearly visible on the daily chart. AUD/USD recouped most of Wednesday’s losses as a slew of weaker US economic data drove the US dollar lower, the benefit of AUD/USD.

Friday’s bullish close confirms a 3-bar bullish reversal pattern called a morning star formation. At the beginning of the week, my preferred option is to seek bullish reversal patterns on intraday timeframes if prices retrace within Friday’s range. Yet I do not yet see this as a significant low, and doubt this will rally to 66c. So if this does indeed bounce, I will then be on the lookout evidence of a swing high and for momentum to then turn lower.

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

AUD/USD Struggling for upside traction...

Data released on Monday increased the risk that Australian economic growth may have fallen in the December quarter

While it didn’t generate much of a reaction in AUD/USD, Monday’s data deluge did nothing to bolster the bullish case for AUD, be it against the USD or other major currencies. It remains soggy on the charts, struggling along with most other Asian currencies.

Having popped higher on Friday on the back of softness in the US dollar on declining US Treasury yields, AUD/USD was rejected again above .6530 on during the Asian session, continuing the pattern seen on Thursday and Friday. It’s inability to find traction suggests its near-term path may be lower.

Those considering shorts could sell the pair here, with a stop above .6530, targeting a push towards .6490 where AUD/USD attracted bids last week on three occasions. Below, potential uptrend support around .6480 and the double-bottom at .6447 are the next levels to watch.

Data released on Monday increased the risk that Australian economic growth may have fallen in the December quarter

- Information on larger components of the economy will be released on Tuesday

- It’s hard to be bullish AUD based on the recent domestic economic performance

While it didn’t generate much of a reaction in AUD/USD, Monday’s data deluge did nothing to bolster the bullish case for AUD, be it against the USD or other major currencies. It remains soggy on the charts, struggling along with most other Asian currencies.

Having popped higher on Friday on the back of softness in the US dollar on declining US Treasury yields, AUD/USD was rejected again above .6530 on during the Asian session, continuing the pattern seen on Thursday and Friday. It’s inability to find traction suggests its near-term path may be lower.

Those considering shorts could sell the pair here, with a stop above .6530, targeting a push towards .6490 where AUD/USD attracted bids last week on three occasions. Below, potential uptrend support around .6480 and the double-bottom at .6447 are the next levels to watch.

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

- AUD/USD has ample upside momentum right now

- Just as higher bond yields helped power the USD rally this year, lower yields are deflating bullish dollar bets

- US 10-year bond futures and DXY have broken key moving averages this week

- US non-farm payrolls is the largest known event risk on Friday

AUD/USD has surged to a technical level where it’s done plenty of work around in the past, providing an opportunity for traders to establish trades with excellent risk-reward potential. With declining US bond yields suffocating the US dollar rally, directional risks appear slanted to the upside unless we get another hot nonfarm payrolls report later in the session.

- Joined

- 28 May 2020

- Posts

- 7,417

- Reactions

- 14,512

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

The Australian dollar played nicely with yesterday’s bias for an initial bounce ahead of its next leg lower. Yesterday’s doji respected the 200-day EMA, so another small bounce is due. A bullish divergence on RSI (2) has formed on the 4-hour chart, and the prior two candles closed back above the weekly pivot point, following false breaks of it. So today’s bias is a repeat of yesterdays; I suspect another bounce could be due – even if the risk of a break below the 200-day EMA remains. US yields put up a better show than the US dollar yesterday, so I am not convinced the USD correction higher has fully played out.

Bulls may want to seek dips towards the weekly pivot point for a move towards 0.6620. Although it remains up in the air as to whether there is enough appetite for it to simply break above the 4-hour bearish engulfing candle initially, given the lack of news in Asia today.

Bulls may want to seek dips towards the weekly pivot point for a move towards 0.6620. Although it remains up in the air as to whether there is enough appetite for it to simply break above the 4-hour bearish engulfing candle initially, given the lack of news in Asia today.

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

The Australian dollar broke convincingly above 66c following the employment report, and has now fully recovered losses sustained over the past week. The bullish momentum of the past two days likely invalidates any hope of the potential head and shoulders pattern I noted in today’s Asian open report.

The 1-hour chart shows strong bullish momentum heading into 0.6620. It trades above the high-volume node of the prior decline and seemingly on track to head for the 0.6650/60 region. Yet this is not an easy market to be bullish on at these levels, from a reward to risk perspective.

Bulls could either revert to very low times to seek bullish continuation pattern on the assumption AUD/USD will continue higher. Personally, I’d prefer to see a retracement on the 1-hour timeframe before reconsidering its potential for a swing trade long, above or around 66c or the weekly pivot point.

The 1-hour chart shows strong bullish momentum heading into 0.6620. It trades above the high-volume node of the prior decline and seemingly on track to head for the 0.6650/60 region. Yet this is not an easy market to be bullish on at these levels, from a reward to risk perspective.

Bulls could either revert to very low times to seek bullish continuation pattern on the assumption AUD/USD will continue higher. Personally, I’d prefer to see a retracement on the 1-hour timeframe before reconsidering its potential for a swing trade long, above or around 66c or the weekly pivot point.

- Joined

- 21 November 2022

- Posts

- 389

- Reactions

- 989

- Joined

- 28 May 2020

- Posts

- 7,417

- Reactions

- 14,512

The headlines of the employment rate are fin, but ometimes you need to dig a little deeper.

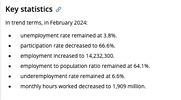

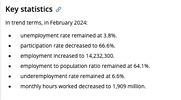

From todays ABS Labour force stats

So, the participation rated dropped, more people not looking for work.

There was an increase in employment, but monthly hours worked decreased.

So obviously it means hors worked per person dropped.

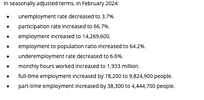

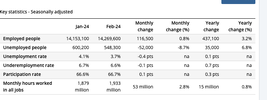

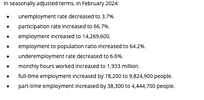

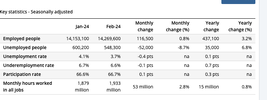

The "seasonally adjusted" data below.

So, to get to the headline unemployment decrease, the data had to be massaged.

Note that the breakdown in full time versus opart time was only mentioned in the seasonally adjusted data section.

Being the cynic that I am, I would suggest that it was because the ABS seasonally adjusted them to death.

The seasonally adjusted fulltime figure of 9,824,900, plus the seasonally adjusted part time figure of 4,444,700 neatly adds up to to the total employment figure of 14,269,600.

But that assumes that non of the part time or full time employees have more than one job.

I call BS on that one.

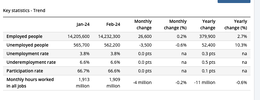

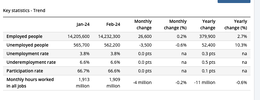

When one looks at the trend figures, we see that rather than the headline "seasonally adjusted " new jobs of 116,500, the actual number was only 26,600.

The unadjusted monthly hours worked fell by 11 million hours, whereas the seasonal adjustments turned it in a plus 15 million hours.

People can read into the stats what they like.

I am reading somewhat differently to the MSM.

Mick

From todays ABS Labour force stats

So, the participation rated dropped, more people not looking for work.

There was an increase in employment, but monthly hours worked decreased.

So obviously it means hors worked per person dropped.

The "seasonally adjusted" data below.

So, to get to the headline unemployment decrease, the data had to be massaged.

Note that the breakdown in full time versus opart time was only mentioned in the seasonally adjusted data section.

Being the cynic that I am, I would suggest that it was because the ABS seasonally adjusted them to death.

The seasonally adjusted fulltime figure of 9,824,900, plus the seasonally adjusted part time figure of 4,444,700 neatly adds up to to the total employment figure of 14,269,600.

But that assumes that non of the part time or full time employees have more than one job.

I call BS on that one.

When one looks at the trend figures, we see that rather than the headline "seasonally adjusted " new jobs of 116,500, the actual number was only 26,600.

The unadjusted monthly hours worked fell by 11 million hours, whereas the seasonal adjustments turned it in a plus 15 million hours.

People can read into the stats what they like.

I am reading somewhat differently to the MSM.

Mick

- Joined

- 28 May 2020

- Posts

- 7,417

- Reactions

- 14,512

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

Last week the RBA held their cash rate at 4.35% and removed their slight hawkish bias from their statement. By Tuesday’s close, AUD/USD traded at a 9-day low and large speculators pushed net-short exposure to a record high. Yet a dovish FOMC meeting and strong employment report for Australia sparked a bout of short covering and allowed AUD/USD to briefly trade above the 200-day average. Although a stronger US dollar has now driven AUD/USD lower once more, and we’re eyeing its potential for a break below 65c to confirm a head and shoulders top pattern.

However, with net-short exposure at a record high, there are risks of a sentiment extreme that could limit downside potential for AUD/USD. And when you consider its ability to remain above 63c over the past year, then it’ possible AUD/USD could remain above this level unless the weekly truly fall off the global or Australian economy.

Bailxtrader

Australian Republic Today

- Joined

- 30 January 2024

- Posts

- 373

- Reactions

- 582

For those who do charting, does the following analysis stck up?

In two weeks time I am heading to the US for 10 weeks, and need to maximise my conversion funds.

Mick

View attachment 173487

Similar threads

- Replies

- 20

- Views

- 16K