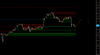

The EURUSD confirmed a mixed closing last night managing however to remain above the 1,10 level. The pair is still interior the negative outside day with 1,1110 – 1,0885 still the levels to follow. Only a daily closing above 1,1110 will support higher levels.

However, while below the 200 days line at 1,1111 the pair will remain under pressure!!

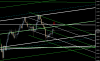

The indicators of the daily chart are still well negative for now while those of the s/t charts are instead still showing a mixed picture supporting further consolidation/ correction. Only an hourly closing above 1,1075 will favour a higher retracement suggesting a 1,11 overshooting!!

I stay still on the sideline waiting for higher levels to sell!!

However, while below the 200 days line at 1,1111 the pair will remain under pressure!!

The indicators of the daily chart are still well negative for now while those of the s/t charts are instead still showing a mixed picture supporting further consolidation/ correction. Only an hourly closing above 1,1075 will favour a higher retracement suggesting a 1,11 overshooting!!

I stay still on the sideline waiting for higher levels to sell!!