And another question guys:

Although not usually effective, in my manual testing and trading of a system I have evidence that a wide trailing stop is effective at getting me out at the end of a move. When I have tried to implement trailing stops in the past I have gotten very strange backtesting results in AB. I ran an extensive optimisation and the most profitable settings (by far) was trailing stop set at "0%".

Can anyone shed any light on exactly how AB executes a trailing stop set at 0%?

The way I see trailing stops is if you set it at say 5%, if your stock drops 5%after you buy it, you sell, and if you stock rises 20%, then drops 5% you sell, locking in 15% profit.

The stops are set to execute intraday but buy and sell signals are on the open.

Not sure how AB executes with a 0% trailing stop?

Thanks.

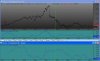

Although not usually effective, in my manual testing and trading of a system I have evidence that a wide trailing stop is effective at getting me out at the end of a move. When I have tried to implement trailing stops in the past I have gotten very strange backtesting results in AB. I ran an extensive optimisation and the most profitable settings (by far) was trailing stop set at "0%".

Can anyone shed any light on exactly how AB executes a trailing stop set at 0%?

The way I see trailing stops is if you set it at say 5%, if your stock drops 5%after you buy it, you sell, and if you stock rises 20%, then drops 5% you sell, locking in 15% profit.

The stops are set to execute intraday but buy and sell signals are on the open.

Not sure how AB executes with a 0% trailing stop?

Thanks.