You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Medium/Longer Term Stock Portfolio

- Thread starter aus_trader

- Start date

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

If a bear market is in play then this would become very profitable. Just have an exit strategy in place in case the market turns around and heads back up and the slide is just a deep pull back.he he I went short BHP Friday. I Think If it Breaks below $30 Gaaaaawn

- Joined

- 26 March 2014

- Posts

- 20,741

- Reactions

- 13,774

Bad news for coal miners in the long term.

https://www.abc.net.au/news/2018-11...m-future-for-australian-thermal-coal/10452456

https://www.abc.net.au/news/2018-11...m-future-for-australian-thermal-coal/10452456

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

Something to consider when formulating a longer term investment strategy, thanks for posting this info SirRumpole.Bad news for coal miners in the long term.

https://www.abc.net.au/news/2018-11...m-future-for-australian-thermal-coal/10452456

I think we are a little biased as Aussies towards coal, even the industry keeps on forecasting rosy picture as described in the article. But we could get isolated in the push for continued coal as a fuel as other nations are looking for a more cleaner greener future with the technological advancements in renewables etc. So it looks like the climate change effects are starting to get acknowledged and innovative nations are embracing new ways to disrupt the traditional CO2 producing oil/coal dominance. Hope we don't become a nation of dinosaurs in the energy space by holding onto beliefs too strongly and denying the reality.

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

Bought 2nd gold related investment for the longer term. Gold price seems to have picked up during

the last few months but heading lower again. Hence providing an opportunity to diversify into other gold investments or to add to my holdings. I decided to look for other gold assets and bought a global gold miners ETF. I have some Aussie gold miner exposure in the Speculative Stock Portfolio, so this one is for exposure outside Australia.

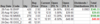

Betashares Global Gold Miners ETF (MNRS) consists of the top gold miner holdings from around the world including Canada, South Africa and USA. Below is further information on the fund:

Open Portfolio:

the last few months but heading lower again. Hence providing an opportunity to diversify into other gold investments or to add to my holdings. I decided to look for other gold assets and bought a global gold miners ETF. I have some Aussie gold miner exposure in the Speculative Stock Portfolio, so this one is for exposure outside Australia.

Betashares Global Gold Miners ETF (MNRS) consists of the top gold miner holdings from around the world including Canada, South Africa and USA. Below is further information on the fund:

Open Portfolio:

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

Following on from the first crack at Cleanaway Waste Management Ltd (CWY), the company seems to be doing a few things to innovate solutions to tackle waste and recycling matters. Their strategy to 2025 is mentioned in the recent announcements as well:

So having another crack at this and added it to this portfolio.

Open Portfolio:

So having another crack at this and added it to this portfolio.

Open Portfolio:

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

With prices coming off the boil it's tempting to buy a few heavily fallen stocks. But I'm going to hold off in case the decline continues. So I'm happy buying things for the long term such as gold related.

What about oil ? It's fallen steadily from US$75 levels to US$49 levels. Don't know how low this thing can go, perhaps to US$30 levels reached in 2016 or lower ? Might not fully engage into gear yet by fully investing but I might start to clutch in and start to bite with a small position at these levels for the long term.

Some pros and cons going through my mind for not going too deep into oil compared to say gold:

Pros:

- World still needs oil (industrialisation of China/India and other developing nations hasn't stopped)

- Renewables only make up a tiny fraction of the energy pie

- Other than costly and unpopular practices such as fracking, there hasn't been any major (Saudi Arabia size) oil discoveries of late and probably won't be since most of the Earth's surface has been explored except maybe the deepest of the seas

- Any political issues and military issues especially in or close to oil producing nations cause oil to rise and we've been in the most peaceful of times of late with alliances between the Saudis and Trump

Cons:

- Although slow to progress, new innovations like electric cars and other battery powered machinery is slowly taking a small slice of the oil based fuel (such as petrol, diesel) market

- Trump and Saudis could become even more best buddies and completely depress the oil market to levels not seen for decades even diving below 2016 low's

-Although insignificant at the moment, the renewable energy generation technologies could take off and take a bigger slice of the global energy pie

- A recovery in the nuclear energy markets could also put downward pressure on oil

If I'm planning to hold long term it's better to go with an oil ETF rather than taking on individual company risk by buying a stock. So purchased some BetaShares Crude Oil ETF (OOO).

Open Portfolio:

What about oil ? It's fallen steadily from US$75 levels to US$49 levels. Don't know how low this thing can go, perhaps to US$30 levels reached in 2016 or lower ? Might not fully engage into gear yet by fully investing but I might start to clutch in and start to bite with a small position at these levels for the long term.

Some pros and cons going through my mind for not going too deep into oil compared to say gold:

Pros:

- World still needs oil (industrialisation of China/India and other developing nations hasn't stopped)

- Renewables only make up a tiny fraction of the energy pie

- Other than costly and unpopular practices such as fracking, there hasn't been any major (Saudi Arabia size) oil discoveries of late and probably won't be since most of the Earth's surface has been explored except maybe the deepest of the seas

- Any political issues and military issues especially in or close to oil producing nations cause oil to rise and we've been in the most peaceful of times of late with alliances between the Saudis and Trump

Cons:

- Although slow to progress, new innovations like electric cars and other battery powered machinery is slowly taking a small slice of the oil based fuel (such as petrol, diesel) market

- Trump and Saudis could become even more best buddies and completely depress the oil market to levels not seen for decades even diving below 2016 low's

-Although insignificant at the moment, the renewable energy generation technologies could take off and take a bigger slice of the global energy pie

- A recovery in the nuclear energy markets could also put downward pressure on oil

If I'm planning to hold long term it's better to go with an oil ETF rather than taking on individual company risk by buying a stock. So purchased some BetaShares Crude Oil ETF (OOO).

Open Portfolio:

- Joined

- 14 May 2013

- Posts

- 309

- Reactions

- 274

Haven't read up on this in detail but on ABC news Alan Kohler was describing how oil from US (mainly from fracking) had resulted in increased supply.

This probably accounts for lower prices. Also makes it difficult for OPEC/Saudi to reduce supply

This probably accounts for lower prices. Also makes it difficult for OPEC/Saudi to reduce supply

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

What about the long term? Is supply of oil likely to exceed demand for extended period?Haven't read up on this in detail but on ABC news Alan Kohler was describing how oil from US (mainly from fracking) had resulted in increased supply.

This probably accounts for lower prices. Also makes it difficult for OPEC/Saudi to reduce supply

- Joined

- 14 May 2013

- Posts

- 309

- Reactions

- 274

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

This is certainly interesting how a lot of new production has come into the market of late specially US and Russia.

Hey look at it from a positive, we might be paying lower prices at the fuel station for quite some time

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

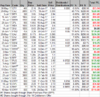

Bit disappointed with letting go of Cleanaway Waste Management Ltd (CWY) but it hasn't held up well over this period given it's usually the time of the year when stocks get a boost from Santa Clause rally. Sold this morning for $1.63 per share.

Oil is in freefall so added to my ETF position by buying another parcel of BetaShares Crude Oil ETF (OOO).

Closed Positions:

Open Portfolio:

Season's greetings to everyone

Oil is in freefall so added to my ETF position by buying another parcel of BetaShares Crude Oil ETF (OOO).

Closed Positions:

Open Portfolio:

Season's greetings to everyone

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

Although the market has been in a strong rally since the start of the year, I felt cautious buying into it. In fact some of the Gold related Entities in this portfolio is a reflection of this.

The healthcare sector has shown defensive qualities in the past and have remained steady or declined more slowly during any market declines. So I'd be happy holding a healthcare stock through thick and thin as long as it does not crash, especially if it pays a good dividend. With that in mind, today bought Estia Health Ltd (EHE) which has a nice 7% dividend yield. It is an aged care operator that has assets in the Eastern states of the country, see below:

Open Portfolio:

The healthcare sector has shown defensive qualities in the past and have remained steady or declined more slowly during any market declines. So I'd be happy holding a healthcare stock through thick and thin as long as it does not crash, especially if it pays a good dividend. With that in mind, today bought Estia Health Ltd (EHE) which has a nice 7% dividend yield. It is an aged care operator that has assets in the Eastern states of the country, see below:

Open Portfolio:

You should be pleased with SSM. Has shown over 100% gain for me over 18 months or so, especially, with most gains this year.Added the company "Service Stream (SSM)" to the portfolio today. This is stock that has appeared in quite a few of the forums, so I've dug into it to find out what the story is about. From my research this has been a beneficiary of the National Broadband Network (NBN) due to the network services it offers and this is probably reflected in the run up in the share price. As the NBN is still new, SSM may continue to benefit with the services it offers, as it has done in the last few years with growing profits. SSM has also upgraded it's earnings outlook for FY17' as announced on 16-05-17.

Also it offers a dividend, which is always welcome with any of the stocks in this portfolio.

View attachment 71764

Closed Positions:

Vector Vest alerted me to this stock back then.

Zaxon

The voice of reason

- Joined

- 5 August 2011

- Posts

- 800

- Reactions

- 882

I'm also a happy holder of SSM. We're a significant part of the NBN rollout.You should be pleased with SSM. Has shown over 100% gain for me over 18 months or so, especially, with most gains this year.

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

SSM is going along nicely.I'm also a happy holder of SSM. We're a significant part of the NBN rollout.

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,146

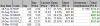

There may be some stocks that could be worthy of being bought for the longer term since their share prices have come down a long way due to the global pandemic situation that we find ourselves in. Caution has to be exercised to minimize the chance of buying companies that could be severely and permanently affected since some may not survive.

Looking at the airlines, which is a gamble at the moment with international flights severely reduced or cut off in a lot of countries, I was looking to see if there is at least one airline that I could put into this portfolio that has the best odds of survival in the long term. I think the best of the Airline companies with good balance sheets may survive and prosper once the pandemic ends but by then the weakest and the most heavily indebted may have gone under...

I looked at the balance sheets and did a bit of research on US airlines such as Delta Air Lines, Inc. (DAL), Southwest Airlines Co (LUV), American Airlines Group Inc (AAL) and United Airlines Holdings Inc (UAL). They are in a dire situation to survive in terms of cashflow to pay for debt obligations and although the US government and FED may bail out some, it may not be all of them and what if I buy one that goes under? The fact that Warren Buffet recently sold out of the US airline stocks that he was really 'fond of / proud of' also instils fear in me to touch any one of these.

So that took my research closer, looking at the local airline stocks. Of the two major Aussie Airlines, it looks like Qantas (QAN) may be able to survive possibly with capital raisings or some form of Govt assistance but Virgin (was VAH when it traded on the ASX) has gone under. So other than a few regional players, I am not able to find a major airline to cut my teeth into at the moment locally speaking.

So I decided to go across the Tasman ditch and investigate our neighbour. So in the case of NZ, based on my research I believe Air New Zealand (AIZ) will be the best of the candidates to survive out of all the abovementioned airline stocks I've looked at. AIZ is actually flying locally within the country and a few selected international routes at the moment, so I think it could be looking at self-sustaining until the world could open up again. Besides I really doubt if NZ Govt would deny any assistance if the national airline was struggling and was facing bankruptcy.

So I bought a few shares of Air New Zealand (AIZ) today for the long term. Not going to trade it in the Speculative Stock Portfolio, the share price is as flat as a pancake at the moment and could break out in either direction and I intend to hold through such volatility as this portfolio gives me the freedom to do so with a long term horizon.

Open Portfolio:

Looking at the airlines, which is a gamble at the moment with international flights severely reduced or cut off in a lot of countries, I was looking to see if there is at least one airline that I could put into this portfolio that has the best odds of survival in the long term. I think the best of the Airline companies with good balance sheets may survive and prosper once the pandemic ends but by then the weakest and the most heavily indebted may have gone under...

I looked at the balance sheets and did a bit of research on US airlines such as Delta Air Lines, Inc. (DAL), Southwest Airlines Co (LUV), American Airlines Group Inc (AAL) and United Airlines Holdings Inc (UAL). They are in a dire situation to survive in terms of cashflow to pay for debt obligations and although the US government and FED may bail out some, it may not be all of them and what if I buy one that goes under? The fact that Warren Buffet recently sold out of the US airline stocks that he was really 'fond of / proud of' also instils fear in me to touch any one of these.

So that took my research closer, looking at the local airline stocks. Of the two major Aussie Airlines, it looks like Qantas (QAN) may be able to survive possibly with capital raisings or some form of Govt assistance but Virgin (was VAH when it traded on the ASX) has gone under. So other than a few regional players, I am not able to find a major airline to cut my teeth into at the moment locally speaking.

So I decided to go across the Tasman ditch and investigate our neighbour. So in the case of NZ, based on my research I believe Air New Zealand (AIZ) will be the best of the candidates to survive out of all the abovementioned airline stocks I've looked at. AIZ is actually flying locally within the country and a few selected international routes at the moment, so I think it could be looking at self-sustaining until the world could open up again. Besides I really doubt if NZ Govt would deny any assistance if the national airline was struggling and was facing bankruptcy.

So I bought a few shares of Air New Zealand (AIZ) today for the long term. Not going to trade it in the Speculative Stock Portfolio, the share price is as flat as a pancake at the moment and could break out in either direction and I intend to hold through such volatility as this portfolio gives me the freedom to do so with a long term horizon.

Open Portfolio:

Similar threads

- Replies

- 44

- Views

- 5K

- Replies

- 37

- Views

- 5K