- Joined

- 5 August 2021

- Posts

- 403

- Reactions

- 945

EOW Update

What a week of continued ups and downs with a pretty large drawdown from our highs of last week. ASX200 ended friday @ 7,921.30 recovering some of the losses for the week. The strong close that I am sure a lot of us were holding on hope for.

Resources have been absolutely crushed over the last few months, as mentioned in my above post URNM was forcefully liquidated and it looks like a good move, with Albo banning a Uranium operation in the Northern Territory. I am always concerned when I see politicians blocking viable mining operations that ultimately benefit indigenous communities and often have large kick backs to upskill and lift communities out of poverty. I frequently wonder if these objections to mining operations/industry are coming from the actual Indigenous people or from inner-city indigenous activist groups. Anyways enough of my ranting on politics.

None the less capital was redeployed to MVR reiterating what I stated yesterday, I like this fund as no asset has more then an 8% weighting (enabling me to not become over exposed to BHP which is already an index heavy weights in the A200 index fund)

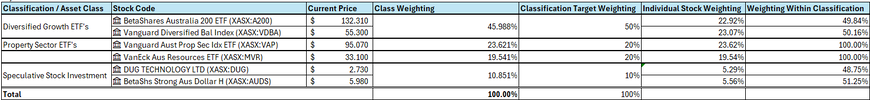

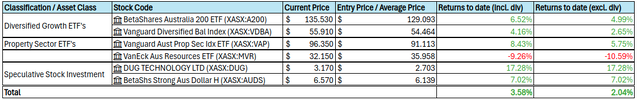

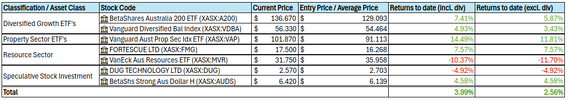

As seen below, we have fallen from our 2.03% total return to 1.19% weightings are still on target, 20.38% in the resource sector and all else within +/- 5% of there target weightings.

Profit / Loss

Weighting

Current Value v.s. Portfolio Cost

Looking Forward:

It is worth noting that BetMakers Technology releases there quarterly results on Monday, if we don't get a positive result the SP will crash and I will be liquidating my entire BetMakers position (this includes additional shares not outlined in the above portfolio). In this event I will look to reallocate this money into either AUDS a leveraged long AUDUSD bet or wait for an appropriate time to deploy it into HJPN (currently waiting to see what happens to the YEN)

Onwards & Upwards

What a week of continued ups and downs with a pretty large drawdown from our highs of last week. ASX200 ended friday @ 7,921.30 recovering some of the losses for the week. The strong close that I am sure a lot of us were holding on hope for.

Resources have been absolutely crushed over the last few months, as mentioned in my above post URNM was forcefully liquidated and it looks like a good move, with Albo banning a Uranium operation in the Northern Territory. I am always concerned when I see politicians blocking viable mining operations that ultimately benefit indigenous communities and often have large kick backs to upskill and lift communities out of poverty. I frequently wonder if these objections to mining operations/industry are coming from the actual Indigenous people or from inner-city indigenous activist groups. Anyways enough of my ranting on politics.

None the less capital was redeployed to MVR reiterating what I stated yesterday, I like this fund as no asset has more then an 8% weighting (enabling me to not become over exposed to BHP which is already an index heavy weights in the A200 index fund)

As seen below, we have fallen from our 2.03% total return to 1.19% weightings are still on target, 20.38% in the resource sector and all else within +/- 5% of there target weightings.

Profit / Loss

Weighting

Current Value v.s. Portfolio Cost

Looking Forward:

It is worth noting that BetMakers Technology releases there quarterly results on Monday, if we don't get a positive result the SP will crash and I will be liquidating my entire BetMakers position (this includes additional shares not outlined in the above portfolio). In this event I will look to reallocate this money into either AUDS a leveraged long AUDUSD bet or wait for an appropriate time to deploy it into HJPN (currently waiting to see what happens to the YEN)

Onwards & Upwards