- Joined

- 20 July 2021

- Posts

- 13,696

- Reactions

- 19,067

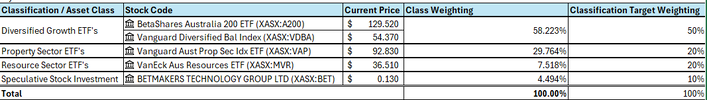

going to be tricky weighting by current market value , and the timing of rebalancing ( say every two or three months ) could be pivotal as well , you might have to adjust rebalancing dates after some experimentation , after all some of the ETFs do that automatically for youDetermined by current market value :

current_holding_value / total_pf_value

good luck

PS careful with the resource sector , it is normally cyclical and this seems to be an unusual cycle