- Joined

- 20 July 2021

- Posts

- 13,658

- Reactions

- 18,999

well proper analysis and research costs you $$$ either via your full service broker or a paid subscription ( and even then you should research deeper and further )Hi, please forgive my noobness and perhaps naivety...

Can simplywall.st be relied on for stock assessments?

Seems yahoo and others link to this site, makes me think it's more of a promo site than a research tool?

Thanks

however that doesn't stop simplywall.st and others from being a useful tool ( part of an array of useful hints where to look )

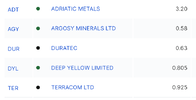

https://www.marketindex.com.au/highest-dividend-yield i use this as a STARTING PLACE quite often to lead to further research , if i find something interesting , and on the way to a decision simplywall.st is often looked at as well , nearly all free data tends to be a little out of date , but if you are not short-term trading , that is not so tragic

don't forget to check the ASX announcements ( which is reasonably up to date on most stocks and also any tools on your trading platform )

try a combination ( and not always the same combination ) and proceed with a mind-set to avoid bad stocks ( rather than chasing the next big winner )

cheers