- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

So I want to have a look at the depth on some future's contracts.

I've got an account with IB and the Sydney Future's exchange is free so the SPI is ok (and I have that working.

I'm a little confused as to what contracts trade on what exchanges though. Some help here would be appreciated.

http://individuals.interactivebrokers.com/en/index.php?f=marketData&p=mdata#asia

That's the link for the market data costs with IB.

Am I reading that correctly that I could sign up for SGX data for only $1 and that would allow me to trade both the Nikkie and the Taiwan Index Future?

Just confused as to what contracts trade with what exchanges.

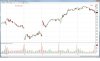

Had some time this morning so decided to see if I could predict the future.

We are going to open right at the highs after a strong session overnight. I tend to favor a a fall back from the open in typical 'fill the gap' style and then from there who knows. It's pretty rare from a gap up that you keep going into further highs and I still think this market will 'catch its breath' for a little bit longer before taking the next step up.

View attachment 50933

Also interesting to see the AUD come away over the recent weeks. I guess this will continue to provide support for our market.

In regards to the SPI and the and the ASX200 I assume it keeps pretty much in line as both markets are pretty liquid and there seems to be bots everywhere to take advantage of any 'price gaps'.

From a practical trading perspective, even if the spread widens/narrows beyond what it should, that doesn't necessarily give a trade opportunity as your average retail trader doesn't have access to both buy the entire index of stocks and sell the future, it may however provide another 'clue' as to what may happen next.

Here's a thread showing the results of my 3 month arbitrage game with 2 CFD providers... unfortunately the way they price the instruments has changed and so this is no longer possible.

https://www.aussiestockforums.com/forums/showthread.php?t=14588

I like your thinking and the fact that you crsytalised and structured your thoughts by writing them all down. Sometimes the market can be cracked simply with good application of creative thinking and logic.

This guy is a boss

http://www.nobsdaytrading.com/video-samples/

I'm actually gonna pony up the 50 bucks for the beginner course or w/e. Really Really enjoyed those sample videos.

Also made me realise how ridiculous the SPI is compared to a real market.

Really interesting action in the SPI just before, will write it up tonight as I think it's a good lesson

Not sure, but the SFE one matches what I have

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?