- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

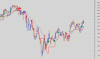

Personally think CSL setting itself in a nice little short entry pattern could be wrong ...... not entering as yet need confirmation . but have placed on watch for now

thanks

P.S PDN may be worth a squiz with them wave counts .........amongst other forms of anyalasis

waves