- Joined

- 14 February 2005

- Posts

- 15,841

- Reactions

- 19,158

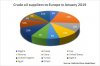

A chart showing petroleum use in Australia by refined products:

https://www.eia.gov/beta/internatio...Australia/images/petroleum_demand_product.png

There's considerable variation between countries however so that's really just for interest. For example Australia doesn't use much fuel oil due to our relative lack of domestic shipping and the dominance of coal and gas as industrial fuels whilst we use more aviation fuel, as a % of the total, than many other countries due to distances etc.

There's also considerable change over time. Eg 50 years ago diesel was a very minor thing lumped in with "other" whereas fuel oil was more significant, aviation fuel was far less than it is now and LPG was basically irrelevant. Those old enough may remember that many years ago trucks and especially buses used to run on petrol not diesel as they do now.

Back to crude oil itself, do those looking at it from a technical perspective have any further thoughts now that WTI is trading around $55?

https://www.eia.gov/beta/internatio...Australia/images/petroleum_demand_product.png

There's considerable variation between countries however so that's really just for interest. For example Australia doesn't use much fuel oil due to our relative lack of domestic shipping and the dominance of coal and gas as industrial fuels whilst we use more aviation fuel, as a % of the total, than many other countries due to distances etc.

There's also considerable change over time. Eg 50 years ago diesel was a very minor thing lumped in with "other" whereas fuel oil was more significant, aviation fuel was far less than it is now and LPG was basically irrelevant. Those old enough may remember that many years ago trucks and especially buses used to run on petrol not diesel as they do now.

Back to crude oil itself, do those looking at it from a technical perspective have any further thoughts now that WTI is trading around $55?