You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

My trading - how I trade for a living

- Thread starter rmt

- Start date

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,513

- Reactions

- 6,754

Seriously I just cant follow your stuff presented.

Peters graphical display however is far more intelligible.

Cant you replicate that.

At least we can follow your progress---although there is nothing offered up as help for the budding trader who wants to make a living replicating---How you trade for a living----???

Peters graphical display however is far more intelligible.

Cant you replicate that.

At least we can follow your progress---although there is nothing offered up as help for the budding trader who wants to make a living replicating---How you trade for a living----???

- Joined

- 12 January 2008

- Posts

- 7,633

- Reactions

- 19,210

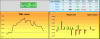

I'll post my graphical update at regular intervals so long as rmt continues to post his xls.

My reasons for monitoring these trades is that I'm starting to swing trades US stocks myself. My past attempts have not been the success I'd like, so I'm gaining experience in seeing how they move. I'm paper trading another 30 trades consecutively to learn how to best manage the trades myself. US stocks get pretty volatile during periods of uncertainty and now earnings season. Opening gaps are quite common and have to be managed. Even though the VIX is low, using tight trailing stops looks unhelpful.

My reasons for monitoring these trades is that I'm starting to swing trades US stocks myself. My past attempts have not been the success I'd like, so I'm gaining experience in seeing how they move. I'm paper trading another 30 trades consecutively to learn how to best manage the trades myself. US stocks get pretty volatile during periods of uncertainty and now earnings season. Opening gaps are quite common and have to be managed. Even though the VIX is low, using tight trailing stops looks unhelpful.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,513

- Reactions

- 6,754

Thanks Peter very helpful

yeah thank you peter,

I will keep up my posting. Many will say oh he is not making any gains in the moment. How can he trade for a living.

First that is how trading works you have to accept that losing is a part of it. I am sure that there will be times when I make decent gains because some of my plays will work out perfectly, but you have to be patient.

Do not rush anything, like you can see my risk is down in the moment. That are all important parts of trading to know how to adjust your risk and to know when your trading is not working out really good.

That is a reason why I think you should have a decent amount of capital to trade for a living

Update later today

I will keep up my posting. Many will say oh he is not making any gains in the moment. How can he trade for a living.

First that is how trading works you have to accept that losing is a part of it. I am sure that there will be times when I make decent gains because some of my plays will work out perfectly, but you have to be patient.

Do not rush anything, like you can see my risk is down in the moment. That are all important parts of trading to know how to adjust your risk and to know when your trading is not working out really good.

That is a reason why I think you should have a decent amount of capital to trade for a living

Update later today

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,544

- Reactions

- 521

I'll post my graphical update at regular intervals so long as rmt continues to post his xls.

My reasons for monitoring these trades is that I'm starting to swing trades US stocks myself. My past attempts have not been the success I'd like, so I'm gaining experience in seeing how they move. I'm paper trading another 30 trades consecutively to learn how to best manage the trades myself. US stocks get pretty volatile during periods of uncertainty and now earnings season. Opening gaps are quite common and have to be managed. Even though the VIX is low, using tight trailing stops looks unhelpful.

View attachment 50417

This is ASF GOLD!

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

I will keep up my posting. Many will say oh he is not making any gains in the moment. How can he trade for a living.

If this is how you make your 'living' how do you cope with taking money out of your account to pay for rent, bills, spending etc? You are flat on p&l after a month, so surely your living costs have decreased your capital base this last month?

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,474

- Reactions

- 1,485

If this is how you make your 'living' how do you cope with taking money out of your account to pay for rent, bills, spending etc? You are flat on p&l after a month, so surely your living costs have decreased your capital base this last month?

Trading for a living with a 1.5 million account...thinking rent is not an issue.

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,544

- Reactions

- 521

Trading for a living with a 1.5 million account...thinking rent is not an issue.

LOL...understatement of the year..

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 15,035

- Reactions

- 13,422

Hi rmt ,

I have been briefly looking at this thread. Would I be right in assuming that your trading on the volatility of the instrument? Assuming the stock prices go up and down (with either an upward trend or even flat trend), you buy at a certain point. If this happens to be a point at which the stock increases in value than you keep going (still need to figure your closing method). If it drops below the your stop, you sell with a small loss.

Assuming stock price was like a sinusoid, your looking to get in at the bottom and sell near the top (but in more short term cycles ). While the average stock price is zero, if you consistently pick the bottom and top you get a nice positive return?

Obviously this only works if you're getting more profits than losses and you profits on average are at least as large as your losses. It helps that you have a very large capital base.

Something along those lines?

I have been briefly looking at this thread. Would I be right in assuming that your trading on the volatility of the instrument? Assuming the stock prices go up and down (with either an upward trend or even flat trend), you buy at a certain point. If this happens to be a point at which the stock increases in value than you keep going (still need to figure your closing method). If it drops below the your stop, you sell with a small loss.

Assuming stock price was like a sinusoid, your looking to get in at the bottom and sell near the top (but in more short term cycles ). While the average stock price is zero, if you consistently pick the bottom and top you get a nice positive return?

Obviously this only works if you're getting more profits than losses and you profits on average are at least as large as your losses. It helps that you have a very large capital base.

Something along those lines?

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,975

Trading for a living with a 1.5 million account...thinking rent is not an issue.

Has rmt stated that he is using a 1.5M account? I haven't read the whole thread.

- Joined

- 22 November 2010

- Posts

- 3,661

- Reactions

- 11

Has rmt stated that he is using a 1.5M account? I haven't read the whole thread.

Yes

Hi Peter,

I will add a tab with a model Portfolio in my excel file. In real I trade a 1.5 Million USD Portfolio therefore even small gains are quiet big. I wouldnt reccommend to trade for a living under 1 Mio USD. I think the good thing about me trading is the fact that you can do it as part time trading as well because you do not have to watch the market all the time

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,975

Thanks, burglar.

I wouldn't necessarily assume someone trading with 1.5M can afford many losses.

Depends on his lifestyle.

I wouldn't necessarily assume someone trading with 1.5M can afford many losses.

Depends on his lifestyle.

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,474

- Reactions

- 1,485

Thanks, burglar.

I wouldn't necessarily assume someone trading with 1.5M can afford many losses.

Depends on his lifestyle.

Can certainly afford more losses than i can

Similar threads

- Replies

- 12

- Views

- 799

- Replies

- 29

- Views

- 2K

- Replies

- 22

- Views

- 4K