- Joined

- 8 March 2007

- Posts

- 3,535

- Reactions

- 4,858

** PS: I suppose it all depends on where you wish to buy your Big Macs **It is also appropriate to note

Sailing for GOLD in Canadian Waters "One Day at a Time

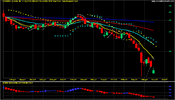

Sailing The EQX

View attachment 143032

As you can see above

GOLD Is Fickle

Too Fickle for me

View attachment 143034

PS: I suppose it all depends on where you wish to buy your Big Macs

PPS : Please note that the BLUE horizontal Line is the 200 Day Moving Average

(for all that is worth)

PPPS : It's always a good idea to keep an eye out on the even the Novice of all Technical Analysts

Sailing Against the Chinese / Hong Kong is like Taking Candy off a Baby

Hang Seng Index is up 2% at Lunchtime

BHP RIO FMG all up approx 4%

Biden, G7 Leaders Announce $600bn Investment In Global Infrastructure To Counter China

The Group of Seven (G7) leading democratic economies has vowed to launch a new partnership aiming to counter China's influence in the developing world.

US President Joe Biden and Group of Seven (G7) leaders leading democratic economies on Sunday formally launched their global infrastructure partnership, aiming to counter China's influence in the developing world. According to the statement released by the White House, leaders of the G7 will invest $600 billion in order to boost the infrastructure. It said that G7 leaders will formally launch the Partnership for Global Infrastructure (PGII) to mobilise hundreds of billions of dollars and deliver quality, sustainable infrastructure that makes a difference in people's lives around the world. Notably, the G7 comprises Germany, France, Britain, Italy, Japan, the United States and Canada.

The leaders said that the hefty amount will help in accomplishing strengthening and diversifying supply chains across the globe besides creating new opportunities for workers and businesses. "Together with G7 partners, we aim to mobilise $600 billion by 2027 in global infrastructure investments. And this will only be the beginning. The United States and its G7 partners will seek to mobilise additional capital from other like-minded partners, multilateral development banks, development finance institutions, sovereign wealth funds, and more," according to the statement.

Notably, the fund will counter China’s so-called Belt and Road Initiative, which Western officials have long argued traps receiving countries in debt and with investments that benefit China more than their hosts. While elaborating on the source of funding, the statement said it will come from the private sector, sovereign wealth and global development funds, rather than direct taxes collected from the citizens. As per the plan, among the first initiatives are a $2 billion solar farm investment in Angola in Southwest Africa, $320 million for hospital construction on Ivory Coast, in West Africa, and $40 million to promote regional energy trade in Southeast Asia.

Several key projects announced at G7

The project will include solar mini-grids, solar cabins with telecommunications capabilities, and home power kits. In addition to supporting up to $1.3 million in US exports, the project will help Angola meet their climate commitments, including generating 70% carbon-free power by 2025. Besides, the statement also revealed that the United States Agency for International Development will invest $40 million in Southeast Asia’s Smart Power Program with an aim to decarbonise and strengthen the region’s power system by increasing regional energy trade, accelerating the deployment of clean energy technologies, and actively engaging private sector leaders and key development partners in shared priorities.

READ | Germany: Thousands rally in Munich demanding G7 leaders to act on poverty, climate change

"In addition to U.S. support, like-minded partners are investing including $35 million from the German Development Finance Institution, $30 million from the European Investment Bank, and $15 million from British International Investment, among others. Through this investment, DFC expects to mobilize $78 million in private capital," according to the White House statement. It is worth mentioning the leaders of G7 countries, including US President Joe Biden, UK PM Boris Johnson and five others landed in Germany and have been holding a meeting at Schloss Elmau, a castle resort in the Bavarian Alps in southern Germany. Notably, the G7 comprises Germany, France, Britain, Italy, Japan, the United States and Canada.

Many Thanks for your Thumbs up Officer CratonHere Come the Chinese!

and

Just in time as far as I am concerned as a Technical Analyst

The Dragon has been awoken! IMHO

Brace yourself for some good profits and hold onto your hats

The Hang Seng Index is about to break out @ Dawn 11.30 am AEST

View attachment 143331

And as always keep an eye on our Chinese neighbours Favourite stock in America

ALIBABA

Crikey! It doesn't get any better than this

View attachment 143332

What does this all mean for Australia ?

I guess it will be good for our BIG 3 exporters

BHP RIO FMG and many others ( Except for our wines)

View attachment 143333

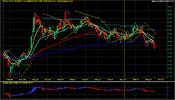

RUN for SHELTER! "Safety at Sea is Paramount"

No Safety in Silver anymore as she breakdown through 200 ma

View attachment 143589

View attachment 143590

No Safety in GOLD either as SILVER often Leads GOLD

View attachment 143593

Russia, one of the world’s biggest producers of gold, cranked up the mining of new gold to compensate for some of the paralyzed assets, Christopher Swift, a national security lawyer at Foley & Lardner, said.

The Bullion Market Association in London, a major hub of the global gold trade, had already suspended transactions with six Russian silver and gold refineries in March.

What the ban on Russia’s gold imports means for its increasingly isolated economy.

The move by the United States, Britain and others builds on steps to cut off Russia from the international financial system.www.nytimes.com

| FLT | FLIGHT CENTRE TRAVEL ORDINARY | 16.03% |

| NAN | NANOSONICS LIMITED ORDINARY | 12.08% |

| BET | BETMAKERS TECH GROUP ORDINARY | 12.04% |

| SQ2 | BLOCK CDI 1:1 NYSE | 11.10% |

| EML | EML PAYMENTS LTD ORDINARY | 10.44% |

| LKE | LAKE RESOURCES ORDINARY | 9.60% |

| RRL | REGIS RESOURCES ORDINARY | 8.95% |

| PNV | POLYNOVO LIMITED ORDINARY | 8.74% |

| ZIP | ZIP CO LTD.. ORDINARY | 7.99% |

| MSB | MESOBLAST LIMITED ORDINARY | 7.95% |

| WEB | WEBJET LIMITED ORDINARY | 7.87% |

| KGN | KOGAN.COM LTD ORDINARY | 7.86% |

| CXO | CORE LITHIUM ORDINARY | 7.85% |

| ING | INGHAMS GROUP ORDINARY | 7.41% |

| CCX | CITY CHIC COLLECTIVE ORDINARY | 7.09% |

| SBM | ST BARBARA LIMITED ORDINARY | 7.07% |

| PDN | PALADIN ENERGY LTD ORDINARY | 6.80% |

| IEL | IDP EDUCATION LTD ORDINARY | 6.75% |

| VUL | VULCAN ENERGY ORDINARY | 6.73% |

| CUV | CLINUVEL PHARMACEUT. ORDINARY | 6.62% |

I'm not familiar with the underlying business of most of them without looking it up but I'd have thought Inghams at least has a viable ongoing business there.Most of these Stocks could be rubbish but there is sometimes Diamonds in most lists

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.