- Joined

- 8 June 2008

- Posts

- 14,670

- Reactions

- 22,252

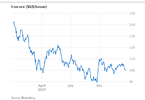

Look at these sorts of charts Is a bit like driving looking into the review mirror. They tell nothing useful at all about what is happening up ahead, and it definitely won’t help you make money investing in Iron Ore companies.Iron Ore Chart still not showing any signs of a recovery.

At best you might say its has bottomed.

Mick

View attachment 184816

Don't assume everyone has the same level capabilities as yourself.Look at these sorts of charts Is a bit like driving looking into the review mirror. They tell nothing useful at all about what is happening up ahead, and it definitely won’t help you make money investing in Iron Ore companies.

I definitely don't assume that, thats why I am offering the hints and tips that I do, to help you level up where I can.Don't assume everyone has the same level capabilities as yourself.

mick

2 opposing forces: full scale recession and cheap brics supplies pushing it down, china QE and anything away from USD pushing it upChinese rebar prices have hit a 3 month high.

Still a long way to go to get close to the ATH in 2021.

Mick

View attachment 185343

Iron ore doesn’t really pay a price for being abundant, because large high grade deposits of it are still sufficiently rare that low cost producers can turn out very good profit margins. In fact much higher profit margins than those mining much rarer metals..

IO does pay the price of being one of the most common mineral on earth so slightly different from copper, coal, oil, or rare earths etc

1% drop in demand forecast, before a 1.2% increase they next yearFrom Bloombergs

View attachment 186436

And the opening gambit from the World World steel

View attachment 186437

Mick

Will be interesting to see if this African Government will decide if China will have to deliver more in the long run.The Chinese are also investing heavily in green steel development. This will happen in 2025 when the high quality ore from the Simandou mine comes on line.

China’s Baosteel expects Simandou mine to start production by 2025

Читайте українськоюЧитайте на русском

Vadim Kolisnichenko

The project with a capacity of 120 million tons will contribute to the green transformation of steel industry

China’s largest steelmaker, Baoshan Iron & Steel (Baosteel), expects to complete infrastructure construction and produce the first iron ore at the Simandou deposit in Guinea by the end of 2025. The company announced this during a briefing on its third quarter results.

The project, located in southeastern Guinea, has an annual production capacity of 120 million tons. It will become the world’s largest deposit of high-grade iron ore, a key raw material for the green transition in the global steel production chain.

China's Baosteel expects Simandou mine to start production by 2025

The project with a capacity of 120 million tons will contribute to the green transformation of steel industrygmk.center

Africa and China != Africa and western countriesWill be interesting to see if this African Government will decide if China will have to deliver more in the long run.

I have little fith in anything to do with Africa.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.