You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Weekly Portfolio - ASX

- Thread starter Warr87

- Start date

-

- Tags

- trend weekly trading

- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,888

It's hard to help without the code but

- Maybe an issue with the timeframeset for the index healthy - if it is used? If so maybe strip sytem back for simplicity

- Explore dates maybe looking into future - perhaps run code check and profile in AFL formula editor (real long shot here )

)

Sorry I can't really help but maybe a couple of things to check / eliminate.

- Maybe an issue with the timeframeset for the index healthy - if it is used? If so maybe strip sytem back for simplicity

- Explore dates maybe looking into future - perhaps run code check and profile in AFL formula editor (real long shot here

Sorry I can't really help but maybe a couple of things to check / eliminate.

- Joined

- 4 December 2008

- Posts

- 486

- Reactions

- 281

I just ran my code against my new Norgate database in AB. It only brought up 1 buy instead of the 6 it should have. Any ideas? I changed my ticker for index to $XAO.au as this is the new convention, but I'm not sure what else I may be missing.

Ideas?

@Skate

Check that your filter is still on the appropriate watchlist.

On the old Premiumdata, were you running the maintenance script on a regular basis?

From the website:

What maintenance do I need to do each day/week?

Run the maintenance script (Tools > XXX-PremiumData) to pick up any code changes, name changes, new listings and delistings as well as changes to the index constituents and watchlists.

As the majority of the database maintenance is done over the weekend, we recommend that the maintenance script is run every Monday (as a minimum).

Look at one of the codes you had a buy for that disappeared, go through each of the filters/buy criteria to make sure it passes each.

I find the interpretation window helpful to plot all your entry and exit criteria. Then you can step through the chart day by day and see what's stopping the trade from triggering.

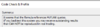

Code:

//Debug interpretation code

printf ("Filters:");

printf (StrFormat("\nXAO Index Constituent? = %g", NorgateIndexConstituentTimeSeries("$XAO") AND NOT OnLastTwoBarsOfDelistedSecurity));

printf (StrFormat("\nPriceRangeFilter = %g", priceRangeFilter ));

printf (StrFormat("\nVolumeFilter = %g", volumeFilter ));

printf (StrFormat("\nIndexFilter = %g", emaFilter ));

printf ("\n\nBuy Conditions:");

printf (StrFormat("\nBuy = %g", Buy) );

printf (StrFormat("\nBuyCond1 = Cross(H,Ref(HHV(H,10),-1)) ) = %g", Cross(H,Ref(HHV(H,10),-1)) ));

printf ("\n\nVariables:");

printf (StrFormat("\nH = %g", H) );

printf (StrFormat("\nHHV(H,10) = %g", HHV(H,10)) );- Joined

- 4 December 2008

- Posts

- 486

- Reactions

- 281

I also just noticed that my index filter is only on for some of the symbols which also makes no sense.

really wish i knew what was going on.

It looks like some of the stocks are looking for a different index symbol to the rest. Are you using something smart in your code to determine the appropriate symbol for the index filer? For example, comparing each symbol against its relevant sector index?

- Joined

- 8 June 2008

- Posts

- 14,704

- Reactions

- 22,333

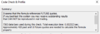

what about the fill gap optionsIt's hard to help without the code but

- Maybe an issue with the timeframeset for the index healthy - if it is used? If so maybe strip sytem back for simplicity

- Explore dates maybe looking into future - perhaps run code check and profile in AFL formula editor (real long shot here)

View attachment 103392

Sorry I can't really help but maybe a couple of things to check / eliminate.

That could maybe affect some code differently?

- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,888

The All Ords closing above a moving average. (weekly)

The stocks that came up are mostly metals. At the moment I don't have a sector filter (and i'm not sure how to implement one too).

It looks like some of the stocks are looking for a different index symbol to the rest. Are you using something smart in your code to determine the appropriate symbol for the index filer? For example, comparing each symbol against its relevant sector index?

@Lone Wolf I questioned this the other day and @Warr87 was only using the XAO at the time, but I did provide some code to do as you say but I don't think @Warr87 is using this at the moment

@Trav.

Now I am really puzzled lol. I never had this come up while using the Premimum Data databased .... I don't even know what code would be future referencing.

@Lone Wolf I ran my maintenance script every friday before I did my update. And I did check the watchlist (i've made that mistake before).

negative.

Now I am really puzzled lol. I never had this come up while using the Premimum Data databased .... I don't even know what code would be future referencing.

@Lone Wolf I ran my maintenance script every friday before I did my update. And I did check the watchlist (i've made that mistake before).

It looks like some of the stocks are looking for a different index symbol to the rest. Are you using something smart in your code to determine the appropriate symbol for the index filer? For example, comparing each symbol against its relevant sector index?

negative.

Donewhat about the fill gap options

View attachment 103394

That could maybe affect some code differently?

- Joined

- 4 December 2008

- Posts

- 486

- Reactions

- 281

I have no idea if this is relevant, but I came across this comment from someone on the amibroker forum who was having trouble with incorrect dates in his explore list.

I have , I think , got to the bottom of my problem

I wished to analyse the data on a weekly basis and had used the Function TimeFrameSet( inWeekly );

I didn't understand that at the end of the first "Exploration Cycle " I had to do the function

TimeFrameRestore ( inDaily);" with the consequence that the exploration continued to look back after each cycle.

6th position now filled. MSB started trading (security issues) this morning.

On another update, I am getting frustrated getting my Norgate data to work into my python backtesters. It was even admitted by Clenow in his section on backtesting in python that the hardest part about python is intergrating the data feed at first which is usually because of the lack of documentation on how to implement it. He also noted that most of the systems available are mostly for US Equities so any non-US equities will present even more problems. Writing the strategies is relatively easy, and versatile once data is available.

Looking at Zipline and Backtrader as backtesting engines. Pyfolio for analysis.

Any advice from someone who has integrated Norgate data and Zipline or Backtrader would be greatly appreciated!

On another update, I am getting frustrated getting my Norgate data to work into my python backtesters. It was even admitted by Clenow in his section on backtesting in python that the hardest part about python is intergrating the data feed at first which is usually because of the lack of documentation on how to implement it. He also noted that most of the systems available are mostly for US Equities so any non-US equities will present even more problems. Writing the strategies is relatively easy, and versatile once data is available.

Looking at Zipline and Backtrader as backtesting engines. Pyfolio for analysis.

Any advice from someone who has integrated Norgate data and Zipline or Backtrader would be greatly appreciated!

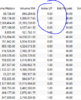

@Warr87, you had PPH as a buy for last week. You also have this again for this week?Week 15

Buy: MLX,WAF,RMS,PDN,PPH

Sell: none

5 positions, with 1 more in the market.

Index is up. 6 orders were placed, 5 have already been filled.

MSB remains open. I'm puzzled by this because there are plenty of buys and sellers in the market and yet nothing is being traded. I can't see any trading halts either. This isn't the first time this has happened.

Any ideas?

View attachment 103364

I have changed over to Norgate from Premium data. It was very easy and a seamless change. Looking forward to see how the python plugins work. In the meantime, AB has been setup to use Norgate.

Sold second position. Thankfully not a loss though with commissions I certainly didn't come out on top.

Holding 2 positions in the same stock throws out my 2% capital rule for risk management.

I blame rushing to run my system and place orders on Friday between my work schedule. Have to be more careful.

Holding 2 positions in the same stock throws out my 2% capital rule for risk management.

I blame rushing to run my system and place orders on Friday between my work schedule. Have to be more careful.

- Joined

- 8 June 2008

- Posts

- 14,704

- Reactions

- 22,333

Did similar today, 2 parcels of same size same price, only realised this evening when entering into spreadsheet..just pray for no unexpected collapse of that share before tomorrowSold second position. Thankfully not a loss though with commissions I certainly didn't come out on top.

Holding 2 positions in the same stock throws out my 2% capital rule for risk management.

I blame rushing to run my system and place orders on Friday between my work schedule. Have to be more careful.

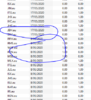

Week 17

Buy: 3 signals (Repeat signals: AEF, PPH, ELD)

Sell: None

9 open positions, 3 more to be added monday. Open PL of $338.

Stop losses raised. My portfolio made 1.41% this week (lost a bit today actually). A few of my positions are having another round of signals which I like to see (sustained signals in one direction is a good sign for me that they are strong).

Week to Week changes:

Buy: 3 signals (Repeat signals: AEF, PPH, ELD)

Sell: None

9 open positions, 3 more to be added monday. Open PL of $338.

Stop losses raised. My portfolio made 1.41% this week (lost a bit today actually). A few of my positions are having another round of signals which I like to see (sustained signals in one direction is a good sign for me that they are strong).

Week to Week changes: