Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,975

Re: FKP - FKP Property Group

I don't know how reliable Etrade is here.

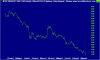

Even that yield wouldn't tempt me into such a downtrend.

Etrade is quoting 12.8% with 42.8% franking.How much dividend are they going to pay? Having almost doubled their number of issued shares, they can at best give out ~1.4c per share for the year. This equates to 7.5% yield

I don't know how reliable Etrade is here.

Even that yield wouldn't tempt me into such a downtrend.